life insurance face amount vs death benefit

That leaves only two possibilities. The exact face value of your.

Face value can also be used synonymously with face amount or coverage amount.

. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. All life insurance policies have a face amount which is also called the death benefit this is the amount thats paid to your beneficiaries after you die. With some types of life contracts whole universal the face amount can grow a higher death.

Ad Find the right amount of coverage for your family with SBLI Life Insurance. I want to note that a universal life insurance death benefit option is different from a death benefit amount change. The face amount can be changed in some instances though its generally easier to.

Ad Get an instant personalized quote and apply online today. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your. So if you buy a policy with a 500000 face value in most.

No Visits to the Doctor. The face amount is the initial death benefit on a life insurance policy. Ad Get Latest Reviews on the Top Life Insurance Companies from Actual Customers Like Yourself.

The face value of a life insurance policy is the death benefit. Face Amount vs Death Benefit. By the same token if it would take 800000 to replace the economic support the man offers his family then the life insurance agent will insist the man get a policy with this amount of death.

Face value is different from cash value which is the amount you receive when you surrender your policy if. First your mother has a Federal Employees Group Life Insurance. 2 The face value of life insurance is.

Universal life insurance allows policy owners to rather easily. It refers to the initial coverage amount of a policy. The death benefit is designed to stay level throughout the life of the policy.

Most life insurance policies intend to provide financial protection for loved ones after you pass. Find the right amount for your family with SBLI. The face amount of a policy is the amount you request when you apply for life insurance.

Apply for guaranteed acceptance life insurance. But as the cash value of the policy changes over time it can alter the total death benefit either above or. The definition of life insurance death benefit is the amount of money payable to the beneficiary or beneficiaries listed on a life insurance policy upon the death of the insured.

Get an Instant Free Quote Online. When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated. As an example if an insured has an outstanding policy loan of 10000 than the ultimate death benefit paid out would be the 100000 less 10000 resulting in a 90000 amount.

With this option your beneficiary receives the death benefit amount only and not also the cash. You cant be turned down due to health. Ive never heard of such a death benefit and dont believe there is one.

The face amount of a whole life insurance policy is the death benefit but it isnt necessary for it to remain the same since the time the policy was signed. They both reflect the amount of money that the insurance company will pay out in the. Do you have enough coverage.

The face amount and thereby the death benefit can. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim. The face amount of a life insurance policy is frequently the same as its death benefit.

The initial amount of money claimed by the beneficiaries on account of. At the beginning of the policy the face value and the death benefit are the same. Do you have enough coverage.

Keep in mind that face amount and paid death benefits are similar. Find the right amount for your family with SBLI. Options start at 995 per month.

The face amount can. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. Ad Find the right amount of coverage for your family with SBLI Life Insurance.

The term Face Amount is similar in nature. How Life Insurance Face Amount and Death Benefits are Calculated. What is the Face Amount of Life Insurance.

If you decide to borrow money from your whole life or universal life insurance policy your coverage will not be terminated unless you decide to terminate it. Within your policy it is officially denoted as the death benefit.

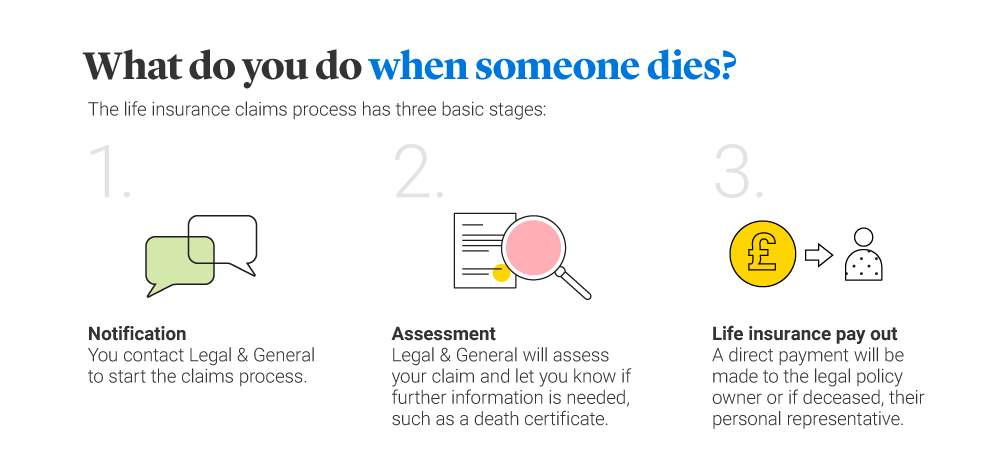

How Do Life Insurance Pay Outs Work Legal General

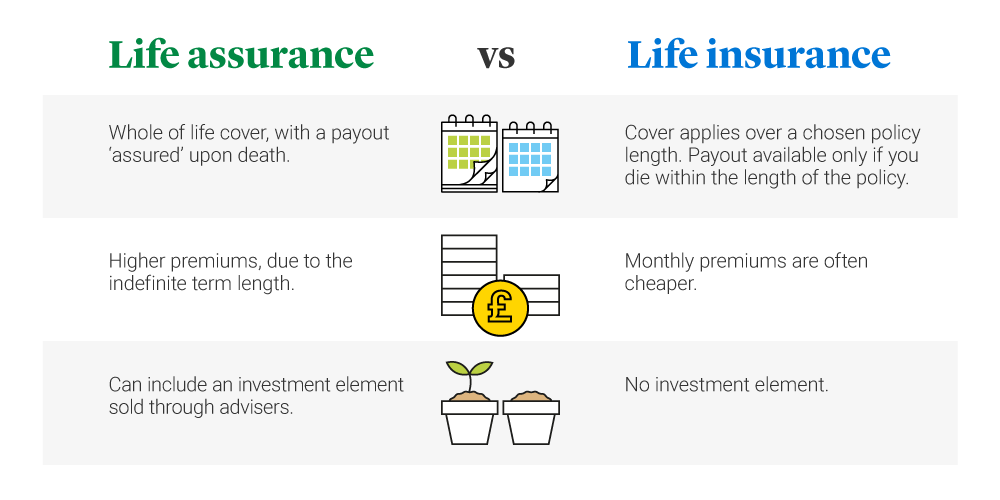

Life Assurance Vs Life Insurance Legal General

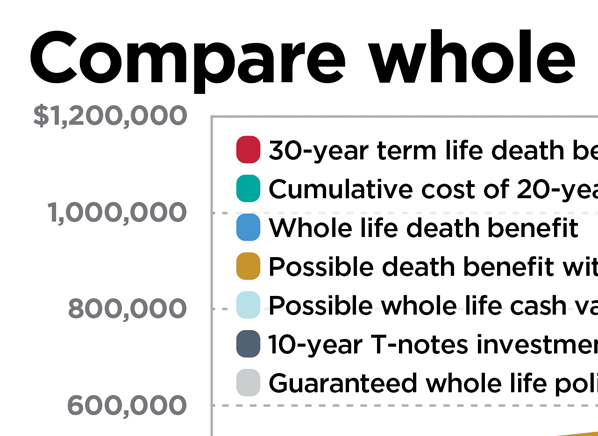

Is Whole Life Insurance Right For You

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Life Insurance Policy Loans Tax Rules And Risks

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

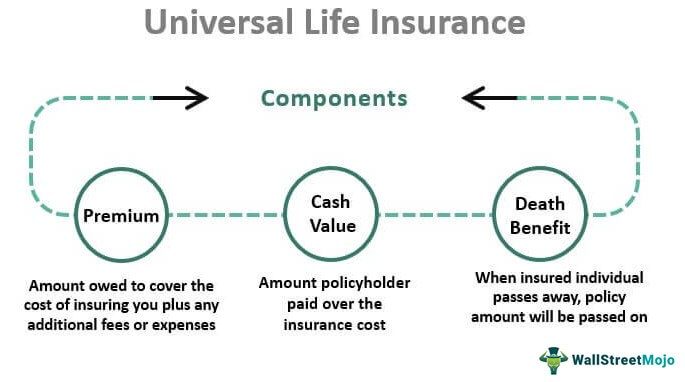

Twitter Universal Life Insurance Life Insurance Quotes Life Insurance Policy

Universal Life Insurance Definition Explanation Pros Cons

Pin On Infographics Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Annuity Vs Life Insurance Similar Contracts Different Goals

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)